UK Tax 'Super Deduction' Comes Into Force

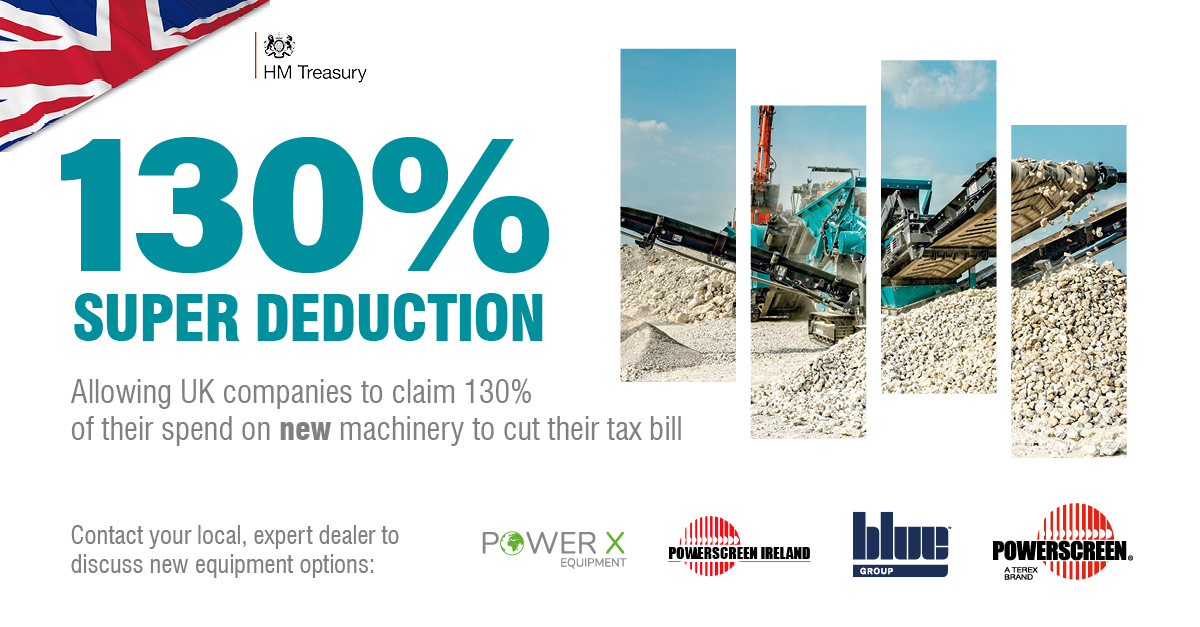

As part of Budget 2021, the UK government has introduced a new Super Deduction for investment in new plants and equipment meaning huge tax savings for businesses.

From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will be able to claim:

- a 130% super-deduction capital allowance on qualifying plant and machinery investments

- a 50% first-year allowance for qualifying special rate assets

The super-deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive.

The government has offered unprecedented support for businesses during Covid. Even so, pandemic-related economic shocks and the accompanying uncertainty have chilled business investment. This super-deduction will encourage firms to invest in productivity-enhancing plant and machinery assets that will help them grow, and to make those investments now.

This UK Government Super Deduction Factsheet contains all the details and excellent explainer video by Chancellor Rishi Sunak makes the benefits very clear.

Contact your local dealer for more information

- Blue Scotland | Scotland & NE England

kirsteen.marke@bluegroup.co.uk | 07827 343 777 - Blue Central | North Wales, NW, Central & SE England

sean.mcgeary@bluegroup.co.uk | 07715 999 670

- Blue Southern | South Wales, Southern England including Greater London

terry.hughes@bluegroup.co.uk | 07738 641 978

- PowerX Equipment | Eastern England (Yorkshire, Humberside, Lincolnshire)

info@pxequip.com | 02476 405 100

- Powerscreen Ireland | Northern Ireland & Republic of Ireland

sales@powerscreenireland.ie | +353 57 867 9034